The $28 Billion AI Tax: Is Oracle Trading the Hospital for the GPU?

In 2022, I was part of the team at Oracle, helping lead the post-close diligence and integration of the Cerner acquisition.

I worked alongside brilliant clinical and technical minds dedicated to a singular mission: proving that a cloud giant could fix the fragmented heart of healthcare.

But in 2026, the "hospital of the future" is facing a $156 billion competitor: The GPU.

This week, the industry was rocked by reports from TD Cowen stating that Oracle is evaluating a sale of Cerner and potentially cutting 30,000 jobs. The reason? A staggering financial pivot to fund its $300 billion OpenAI infrastructure deal.

As a surgeon who has lived in the EHR and a strategist who saw the integration roadmap from the inside, I see this not as a failure of the team, but as a "Regulatory Darwinism" event. Oracle isn’t just selling a business unit; they are paying an "AI Tax" to stay in the hyperscale race.

The $156 Billion Gravity Well

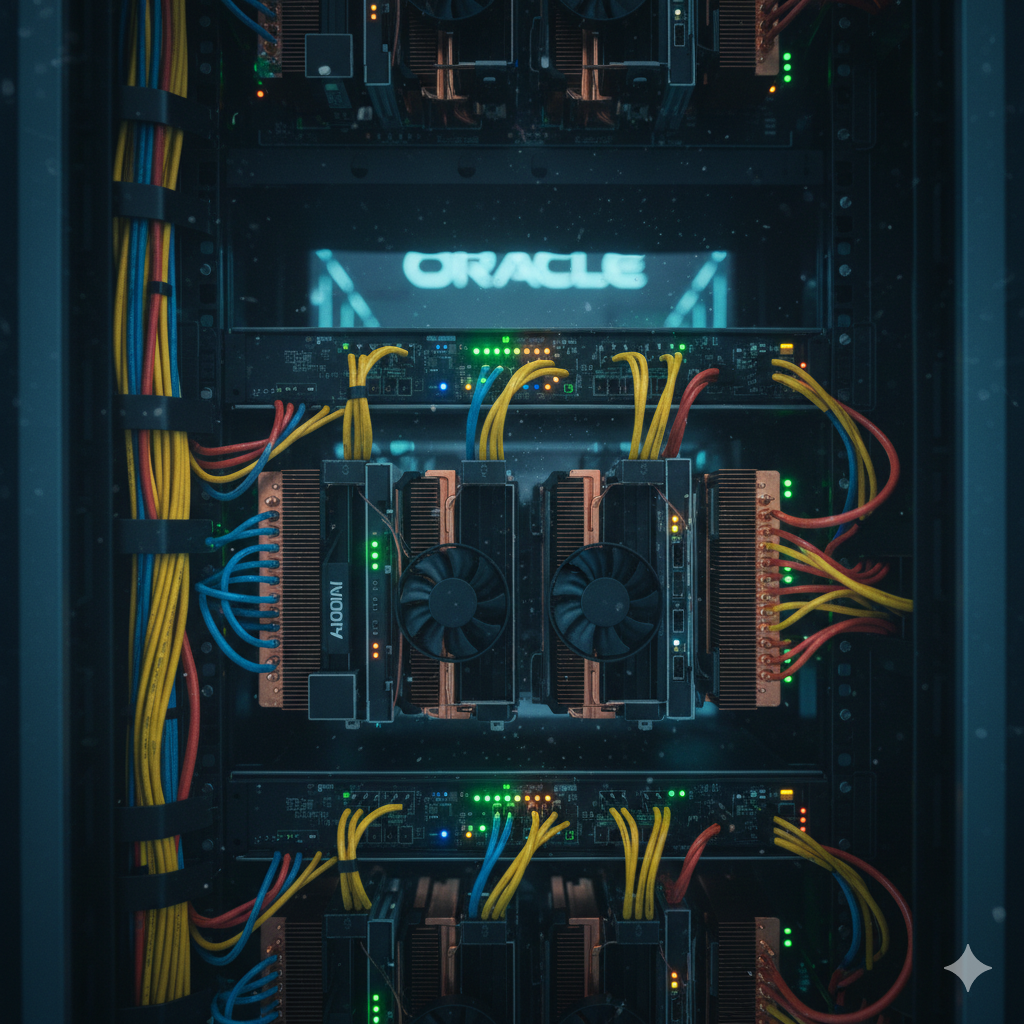

Oracle is currently building the "Stargate" of AI infrastructure. To meet its commitments to Sam Altman and OpenAI, the company needs to deploy roughly 3 million high-end GPUs.

The math is brutal:

Oracle’s capital expenditure for 2026 has jumped to $50 billion.

Total debt has climbed past $100 billion, and to keep the lights on, Oracle is reportedly requiring some customers to pay 40% deposits upfront.

In a world where a giant has to choose between a service-heavy EHR and a high-margin GPU cluster, the clinical record becomes "Slow Money." And in 2026, the market only wants "Fast Money."

The New Map: Winners & Losers of the Great Divestiture

If these reports lead to a sale or spin-off, the healthcare landscape doesn't just shift—it shatters. Here is how the pieces land:

The Big Winner: Epic Systems

Epic is the last titan standing. With over 42% of the U.S. acute-care market, they are now the default "safe" choice. While Oracle fought integration friction, Epic focused on embedding ambient AI natively. Their win is a victory for stability, but it’s a warning for competition. We are entering a "Monopoly Era" for the clinical record.

The Ultimate Loser: Healthcare Providers & Innovation

This is where the real damage happens. When Oracle (the only credible threat to Epic’s dominance) retreats, providers lose their only "Plan B."

The Leverage Crisis: Without a viable alternative, health systems have zero leverage during contract renewals. We’ve already seen lawsuits, like the Texas AG’s case against Epic, alleging that this market power is already raising costs and stifling competition.

The Innovation Winter: Monopolies don't have to innovate; they only have to maintain. If the "EHR War" is over, the pressure to improve clinician UI or lower implementation costs evaporates.

The "Service-Heavy" Trap: If Cerner is sold to a private equity firm (a common fate for "legacy" assets), the focus will shift to cost-cutting, not clinical excellence. The doctors at the bedside will be the ones who pay that price in the form of stagnant software and reduced support.

Get the "Clinical Reality Check" Before Everyone Else.

I send these briefings to my private list 24 hours before they hit social media. Join other healthcare leaders who get the raw, uncensored analysis first.

[Join the Clinical Realist List]

The Global Implications: A "Single Point of Failure"

This isn't just a U.S. problem. Globally, the EHR market is becoming a massive cybersecurity "tail risk."

Cybersecurity Concentration: As noted in recent clinical research, having 90% of U.S. patient records in the hands of essentially two vendors creates a catastrophic single point of failure. One breach could paralyze the global healthcare infrastructure.

The Sovereign Data Conflict: Many nations (especially in the Middle East and UK) were betting on Oracle’s sovereign cloud to host national health records. If Oracle sells the "clinical" layer, those national security agreements could be thrown into legal chaos.

The Clinical Realist Take

I loved my time at Oracle because the vision was grand. But a vision without a sustainable financial tether is just a dream. We are seeing the decoupling of the Clinical Application from the Data Infrastructure.

Oracle might sell the "tank" (the software), but they will fight to keep the "fuel" (the data) on their cloud. As leaders, we have to stop asking which EHR is better and start asking: Who actually owns the ground your data sits on?

Call to Action

Audit your "Distraction Risk." If your primary vendor is under $100B+ in debt and pivoting to AI infrastructure, your implementation roadmap is at risk.

Demand Data Portability. Ensure your clinical data isn't trapped in a "legacy silo" that could be sold to the highest bidder.

Bet on the "Middle Layer." Stop waiting for the EHR monolith to innovate. Look for agile startups that can sit on top of any EHR, ensuring you aren't held hostage by a monopoly.

Are you doubling down on a monolith, or are you preparing for the deconstructed future? Send me a note! I’d love to hear how your system is protecting its leverage.